- Rack-mounted Lithium Battery

- Golf Cart Lithium Battery

-

Golf Cart Lithium Battery

- 36V 50Ah (for Golf Carts)

- 36V 80Ah (for Golf Carts)

- 36V 100Ah (for Golf Carts)

- 48V 50Ah (for Golf Carts)

- 48V 100Ah (Discharge 100A for Golf Carts)

- 48V 100Ah (Discharge 150A for Golf Carts)

- 48V 100Ah (Discharge 200A for Golf Carts)

- 48V 120Ah (for Golf Carts)

- 48V 150Ah (for Golf Carts)

- 48V 160Ah (Discharge 100A for Golf Carts)

- 48V 160Ah (Discharge 160A for Golf Carts)

-

Golf Cart Lithium Battery

- Forklift Lithium Battery

- 12V Lithium Battery

- 24V Lithium Battery

- 36V Lithium Battery

- 48V Lithium Battery

-

48V LiFePO4 Battery

- 48V 50Ah

- 48V 50Ah (for Golf Carts)

- 48V 60Ah (8D)

- 48V 100Ah (8D)

- 48V 100Ah

- 48V 100Ah (Discharge 100A for Golf Carts)

- 48V 100Ah (Discharge 150A for Golf Carts)

- 48V 100Ah (Discharge 200A for Golf Carts)

- 48V 150Ah (for Golf Carts)

- 48V 160Ah (Discharge 100A for Golf Carts)

- 48V 160Ah (Discharge 160A for Golf Carts)

-

48V LiFePO4 Battery

- 60V Lithium Battery

-

60V LiFePO4 Battery

- 60V 20Ah

- 60V 30Ah

- 60V 50Ah

- 60V 50Ah (Small Size / Side Terminal)

- 60V 100Ah (for Electric Motocycle, Electric Scooter, LSV, AGV)

- 60V 100Ah (for Forklift, AGV, Electric Scooter, Sweeper)

- 60V 150Ah (E-Motocycle / E-Scooter / E-Tricycle / Tour LSV)

- 60V 200Ah (for Forklift, AGV, Electric Scooter, Sweeper)

-

60V LiFePO4 Battery

- 72V~96V Lithium Battery

- E-Bike Battery

- All-in-One Home-ESS

- Wall-mount Battery ESS

-

Home-ESS Lithium Battery PowerWall

- 24V 100Ah 2.4kWh PW24100-S PowerWall

- 48V 50Ah 2.4kWh PW4850-S PowerWall

- 48V 50Ah 2.56kWh PW5150-S PowerWall

- 48V 100Ah 5.12kWh PW51100-F PowerWall (IP65)

- 48V 100Ah 5.12kWh PW51100-S PowerWall

- 48V 100Ah 5.12kWh PW51100-H PowerWall

- 48V 200Ah 10kWh PW51200-H PowerWall

- 48V 300Ah 15kWh PW51300-H PowerWall

PowerWall 51.2V 100Ah LiFePO4 Lithium Battery

Highly popular in Asia and Eastern Europe.

CE Certification | Home-ESS -

Home-ESS Lithium Battery PowerWall

- Portable Power Stations

Top 5 OEM Manufacturers of Lithium-Ion Rack Batteries 2024

Top OEM manufacturers of lithium-ion rack batteries include Vertiv, Schneider Electric / APC, Eaton, EG4 Electronics, and Redway Power. Redway Power offers hot-swappable modules and advanced features. Market innovations, like high-voltage batteries for fast charging, shape the industry. Challenges such as supply-demand imbalances and environmental concerns are present, but industry growth remains optimistic.

What are Lithium-Ion Rack Batteries?

Lithium-ion rack batteries are advanced energy storage solutions commonly used in data centers, telecommunications facilities, and industrial settings. They offer higher energy density, longer lifespan, and faster charging times compared to traditional lead-acid batteries. Additionally, they are safer and more environmentally friendly, making them a smart choice for organizations seeking reliable backup power solutions.

Lithium-ion Rack Batteries Market Overview

Lithium-ion rack batteries are pivotal in the energy storage industry, witnessing significant growth driven by demand for electric vehicles and renewable energy integration. China leads due to its aggressive electric mobility push. The global market, including rack batteries, is projected to reach USD 187.1 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 14.2%. The United States battery market size is estimated to reach USD 12.40 billion in 2024 and is expected to grow at a CAGR of 16.65% to reach USD 26.79 billion by 20292. This growth is primarily driven by the declining prices of lithium-ion batteries, increasing adoption of electric vehicles (EVs), growth in the renewable energy sector, and increased sales of consumer electronics.

https://www.redwaypower.com/product/pm-lv51100-3u-lithium-battery-module

Lithium-ion Rack Batteries Market Trends

The lithium-ion battery rack market is on the rise, driven by increasing demand, especially from commercial users. In contrast, markets for nickel-cadmium and nickel-metal hydride battery racks remain smaller. Projections suggest moderate growth for these markets. However, the lithium-ion segment dominates, propelled by its expanding applications and superior performance.

Growth in Electric Vehicles

One of the most significant trends driving the lithium-ion rack batteries market is the rapid growth of the electric vehicle industry. Governments worldwide are setting ambitious targets for electric vehicle adoption, and automakers are responding by launching new EV models. This shift is creating a substantial demand for high-performance lithium-ion batteries to power these vehicles.12

Energy Storage for Renewable Energy

The intermittent nature of renewable energy sources like wind and solar has led to an increased need for energy storage solutions. Lithium-ion rack batteries offer a viable solution for storing excess energy generated during periods of high production and releasing it during periods of low generation or high demand. This trend is expected to continue as renewable energy’s share in the power mix increases.2

Technological Advancements

The lithium-ion battery industry is continuously evolving, with manufacturers focusing on improving energy density, reducing costs, and enhancing safety features. Innovations such as high-nickel cathode materials and solid-state batteries are on the horizon, promising even better performance and longer life cycles for rack batteries.5

Supply Chain and Raw Material Concerns

The demand for lithium-ion batteries has also brought attention to the supply chain and raw material sourcing. Lithium, cobalt, and other critical materials required for battery production are concentrated in a few regions, leading to concerns about supply security and price volatility. The industry is exploring ways to diversify its raw material sources and recycle batteries to mitigate these risks.

Top OEM Manufacturers

Introducing the top OEM manufacturers of lithium-ion rack batteries, these industry leaders are driving innovation and reliability in backup power solutions for data centers and telecom infrastructure. From Vertiv’s seamless integration of high-density batteries to Redway Power’s customized solutions with advanced features, these manufacturers cater to diverse needs, ensuring uninterrupted power supply in critical environments.

Vertiv

Vertiv is a global leader in designing, building, and servicing critical infrastructure that enables vital applications to run continuously, efficiently, and safely. One of the key components in ensuring the reliability and efficiency of critical power systems is the use of advanced battery technology, particularly in the realm of lithium-ion rack batteries.

Lithium-ion rack batteries from Vertiv represent a significant advancement in energy storage solutions, offering a range of benefits that make them an ideal choice for a variety of applications, including but not limited to data centers, telecommunications, and industrial settings.

Schneider Electric / APC

Schneider Electric, a global specialist in energy management and automation, offers a range of high-performance lithium-ion rack batteries through its APC brand. These batteries are designed to provide reliable and efficient energy storage solutions for various applications, including critical power, backup power, and renewable energy systems.

Eaton

Eaton is a global leader in power management solutions, providing energy-efficient products and services designed to help customers effectively manage electrical, hydraulic, and mechanical power. A key component of their offerings is their line of lithium-ion rack batteries, which are engineered to deliver reliable and efficient energy storage for a variety of critical applications.

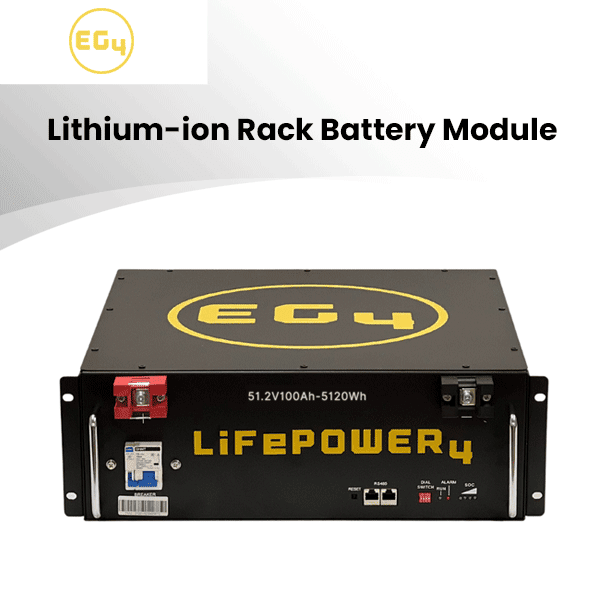

EG4 Electronics

EG4 Electronics is a recognized provider of power solutions, and their lithium-ion rack batteries stand out for their innovation and reliability. These batteries are specifically engineered to cater to the evolving energy storage needs of various sectors, including data centers, telecommunications, industrial automation, and renewable energy systems.

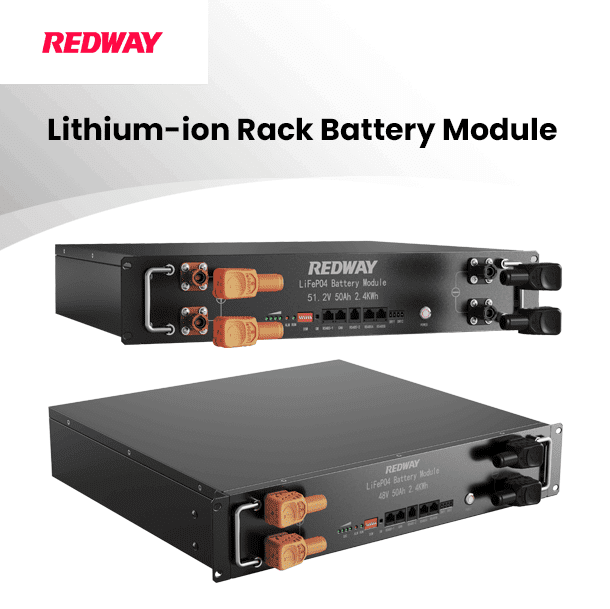

Redway Power

Redway Power is a company recognized for its commitment to innovation and excellence in the field of energy storage solutions. Among their product offerings, Redway Power’s Lithium-Ion Rack Batteries stand out as a premier choice for those seeking reliable, efficient, and high-performance energy storage systems.

In conclusion, these OEMs play a vital role in the data center and telecom industry, with Redway Power standing out for its customized solutions. Clients should evaluate their specific needs before choosing an OEM for their backup power requirements.

Innovations and Opportunities

In the realm of lithium-ion rack battery manufacturing, notable innovators are reshaping the competitive landscape. Redway Power stands out as a custom rack battery OEM, offering tailored solutions with hot-swappable modules and advanced management features. The broader market witnesses significant advancements, including high-voltage lithium-ion batteries enabling fast charging, crucial for diverse applications. Additionally, industry dynamics are evolving with mergers and acquisitions like Arcadium Lithium’s formation, driving efficiency and innovation. Regulatory shifts towards sustainability further influence market trends, shaping the future of lithium-ion battery manufacturing.

Opportunities in the lithium-ion rack batteries market are multifaceted, driven by technological advancements, supportive government policies, and the expansion of applications into new sectors.

Innovation in Battery Chemistry

The pursuit of alternative battery chemistries is opening new avenues for cost-effective and sustainable energy storage solutions. Sodium-ion batteries, for instance, are emerging as a viable alternative to lithium-ion batteries due to the abundance and lower cost of sodium. This shift in chemistry could lead to a more diversified and resilient supply chain, reducing reliance on scarce and geopolitically sensitive lithium resources. According to the International Energy Agency (IEA), the demand for lithium for batteries is expected to increase significantly, and diversifying with sodium-ion could mitigate potential supply risks and cost pressures.

Government Policies and Incentives

Governments worldwide are increasingly recognizing the strategic importance of the battery industry and are implementing policies to support its growth. In the United States, the Inflation Reduction Act (IRA) includes provisions that could significantly boost the domestic production and adoption of electric vehicles and energy storage systems, which in turn benefits the lithium-ion battery market. The act’s incentives for clean energy manufacturing and development are expected to create a more robust domestic supply chain and promote technological advancements in battery technology【32】.

Expanding Applications

The application of lithium-ion rack batteries is not limited to the automotive and energy storage sectors. The telecommunications industry, for example, relies on batteries for backup power, and with the rollout of 5G networks, the demand for reliable and efficient power sources is on the rise. The aerospace and defense sectors also present significant opportunities for lithium-ion batteries due to their high energy density and reliability requirements. The U.S. Department of Energy and other federal agencies are working to ensure that the battery industry in the country remains at the forefront of innovation, supporting the development of advanced battery technologies for various applications.

In summary, the opportunities within the lithium-ion rack batteries market are substantial, underpinned by technological innovation, supportive government measures, and the expansion into new and diverse applications. These factors collectively contribute to the growth and sustainability of the industry, positioning it for a dynamic future.

Future outlook and challenges

Looking ahead, the lithium-ion rack battery industry faces a multitude of challenges amidst its promising growth trajectory. Supply-demand imbalances and potential oversupply issues pose significant hurdles to navigate. Meeting the escalating demand while maintaining quality standards and addressing environmental concerns will be paramount for sustained industry growth. Nevertheless, with proactive measures and strategic collaborations, the future outlook remains optimistic for these top OEM manufacturers in driving innovation and shaping the landscape of lithium-ion rack batteries.

Automotive Application Growth

The automotive sector is anticipated to be a major end-user for batteries, particularly lithium-ion batteries, in the coming years. The penetration of electric vehicles is expected to provide a significant boost to the battery industry growth in North America. The United States is one of the largest EV markets, with about 918,460 plug-in electric light vehicle sales in 2021, witnessing a growth rate of 51.16% from the previous year26. Government initiatives have encouraged investment in EVs and renewable industries, leading to an increased demand for battery-based energy storage systems, primarily led by lithium-ion batteries2.

Manufacturing Capacity Expansion

The United States is expected to witness a ramping up of manufacturing capacity from 55 gigawatt-watts per year (GWh/year) in 2021 to 1000 GWh/year by 20302. Most of the projects in the pipeline are anticipated to initiate production between the years 2025 to 2030, indicating a robust battery market development for the automotive industry in the next few years2.

Government Policies and Support

The U.S. government has been instrumental in driving the growth of the battery market through favorable policies and incentives. The Inflation Reduction Act (IRA), along with the adoption of California’s Advanced Clean Cars II rule by several states, could deliver a 50% market share for electric cars by 20304. Furthermore, the government announced the development of electric vehicle battery plants in North America, with a projected capacity increase from 55 GWh/year in 2021 to 1000 GWh/year by 20302.

Challenges and Opportunities

Despite the growth, the demand-supply mismatch of raw materials may negatively impact the market’s growth and is one of the major restraints for the market2. However, integrating renewables with energy storage systems will provide growth opportunities in the forecast period2. The U.S. government’s focus on establishing a domestic supply chain for lithium-based batteries is expected to create equitable clean-energy manufacturing jobs while helping to mitigate climate change impacts3.

Recycling and Sustainability

The U.S. is also focusing on recycling and sustainability efforts. The National Blueprint for Lithium Batteries 2021-2030 outlines a plan to enable U.S. end-of-life reuse and critical materials recycling at scale, supporting a secure and resilient domestic supply chain that is circular in nature3.